Can Government Print Money To Fund Deficit

In economic word, you may oft hear that a authorities is "printing money" and then motion picture sheets of hundred dollar bills coming off a press press. However, most often this is not what really takes identify when a regime adds to the monetary supply. Coin cosmos in modern economies usually involves creating money that is non concrete. Central banks practise not even have the power to print concrete currency or mint coins – the Treasury department does. So what exactly happens then?

Before we get started…

To make the explanation simpler, below are some terms that yous volition need to know moving forward. In this article we will refer to the United states of america' process of coin creation, and keep it to the basic concepts needed to empathise the bigger pic.

- capital letter – Money, credit, and other forms of funding used to spend and/or invest

- money supply – Total amount of majuscule in existence

- money creation – When the central bank of a country (in the example of the U.S., the Federal Reserve or "the Fed") increases the money supply

- commercial banking company – Depository financial institution that provides services such as accepting deposits, making business loans, offering investment products, etc. Mostly deals with large corporations or businesses rather than individuals.

How coin gets "printed"

Usually when the term printing money is used, it is referring to one of ii processes for increasing money supply. In one process, the Fed buys fiscal avails (don't worry likewise much near what these are, just think of them as big chunks of money not in physical form) from commercial banks. The money the Fed uses to purchase these financial assets is created out of nowhere; it is not existing money that the Fed possesses. This gives commercial banks more money to lend to their customers, which pumps new money into the monetary supply. This is likewise referred to as quantitative easing (QE).

In another procedure, the Fed simply extends a loan to a commercial bank, once again using money that comes out of thin air. The commercial bank then keeps a required fraction (percentage) of the loan money as a deposit, so extends loans to other commercial banks using the remainder of the loan money. These commercial banks that receive the loans from other commercial banks and then do the same thing – keep a required fraction of the loan sum as a deposit and then loan out the rest of the coin as they please. These loans count as money, so therefore the coin supply is increased.

As you lot can see, no physical money is printed in either of these processes. Very lilliputian of the United States' coin supply is in the form of physical currency. Commercial banks may withdraw physical money from the key banking concern, which is but irresolute the form of currency from electronic to paper. This paper money is what actually gets printed. Erstwhile soiled coin can also be exchanged for crisper, cleaner new newspaper money. Dollars that are printed are essentially just paper before whatever value is assigned to them.

What this ways for the U.S. dollar

To explain what printing money does to the dollar, we will utilise an analogy. Take yourself as an case. You are unique and are worth something. Now let's say I cloned you a million times. Now there are a 1000000 of yous, all exactly the same, wandering around. How much is each of you worth at present? A lot less than what you were worth before you were cloned, because there are more of you, you lot are no longer unique, and y'all are easier to accomplish. Now take that analogy and replace yourself with a dollar. This is inflation, and this is why inflation devalues the U.S. dollar.

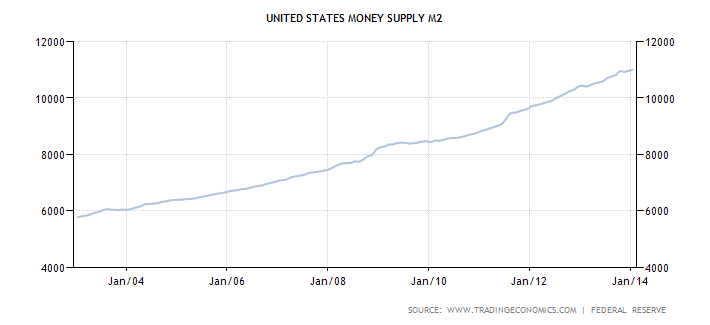

The nautical chart below is what everyday Americans, particularly investors, get concerned most. It shows the increase in the United States' coin supply from the decade spanning January 2004 to January 2014:

As of January of this year, the U.S. money supply stands at $xi,010 billion.

What'south gold got to practise with it?

Why does golden brand a cracking hedge against inflation? At that place are many reasons, but for the sake of relevancy to this article, yous cannot print gold. Gilt is a physical, tangible nugget that you cannot brand appear out of thin air like the Fed does with the U.S. dollar. Therefore, it is a lot more difficult for gold to devalue. Due to inflation, 100 U.S. dollars in the twelvemonth 2000 would merely buy you lot $82 worth of groceries in 2013, while $100 in gold in 2000 would buy you $470 in groceries in 2013.

Take Action

One of your most important financial assets is your retirement business relationship. If your 401(yard) or IRA consists but of U.S. dollars, it has likely already lost value and will keep to do so in the future. Investing some of your retirement funds in golden can offer protection against the dollar'south devaluation. Consider opening up a Gold IRA with American Bullion to have action against what was discussed in this article. Call today at one-800-326-9598 or request your Free Aureate Guide.

Source: https://www.americanbullion.com/what-actually-happens-when-a-government-prints-money/

Posted by: daltonacreme.blogspot.com

0 Response to "Can Government Print Money To Fund Deficit"

Post a Comment